Banks are unique; we treat them that way. Capital actions fueled by data, analytics, and advisory.

Banks are unique; we treat them that way. Capital actions fueled by data, analytics, and advisory.

Latest Videos and webinars

CECL Halftime Show: A Check-in with Four Community Banks and Their Plans for the ‘Second Half’

On this panel, we’ll hear how four bankers prepared for CECL, navigated implementation, and how they hope to mold their CECL process into the future.

PoWER: Climate Risk Analytics for US Community Banks

A first-of-its-kind tool to help you analyze climate-related risk.

A Crisis of Confidence: Liquidity Risk for US Community Banks

A look at the factors we consider to be most significant behind the bank failures of 2023.

Download a Sample Capital Plan

for Community Banks

This Sample Capital Plan examines:

- Limits, triggers, capital ratios, key risk indicators

- Strategic risks, contingency actions, policy & procedure best practices

- Effective executive summaries, and more

The Invictus

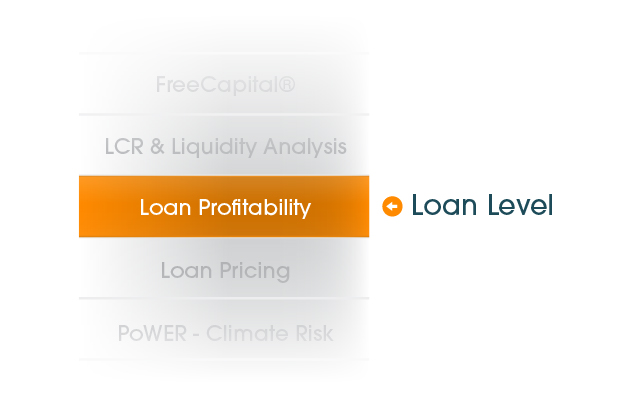

CAPITAL STACK

The Invictus Capital Stack is designed to provide the C-Suite a 360-degree view of your bank's capital position. We start with the most basic components of banking - loans - and eventually build up to a comprehensive view for capital planning. By building each component into the next, you know that the insights delivered by the capital stack are specifically tailored for you.

Each level of the Invictus Capital Stack informs the next. You can deploy any or all components depending on your needs.

The Capital Stack has 4 levels of granularity - all of which contain their own unique insights and inform the overall capital picture of your institution.

Where do you fit on the stack?

Take a look at the product offerings outlined below to see where you should engage with the Capital Stack.

Capital & Strategy

- Capital Stress Testing

- Capital Planning

- LCR & Liquidity Analysis

Loan Portfolio Analytics

- Loan Pricing & Profitability

- Loan-Level CECL Solution

- PoWER - Climate Risk Analysis

BankGenome™ Analytics

- upSCALE - CECL for Small Banks

- BankGenome™ Data As A Service

- The BankGenome™ Project

Loan Level Data

- Data Validation

- Relationship Analysis

Let's Connect

The Invictus Group creates disruptive analytics to give clients and investors a competitive edge. We are leaders, not followers.

A Crisis of Confidence:

Liquidity Risk for US Community Banks

A look at the factors we consider to be most significant behind the bank failures of 2023.

Up next: The Liquidity Analysis that Every Financial Institution Needs to Run ASAP - April 5, 2023